Eliminate Risk of Failure with CIMAPRA19-F01-1 Exam Dumps

Schedule your time wisely to provide yourself sufficient time each day to prepare for the CIMAPRA19-F01-1 exam. Make time each day to study in a quiet place, as you'll need to thoroughly cover the material for the F1 Financial Reporting exam. Our actual CIMA Professional Qualification exam dumps help you in your preparation. Prepare for the CIMAPRA19-F01-1 exam with our CIMAPRA19-F01-1 dumps every day if you want to succeed on your first try.

All Study Materials

Instant Downloads

24/7 costomer support

Satisfaction Guaranteed

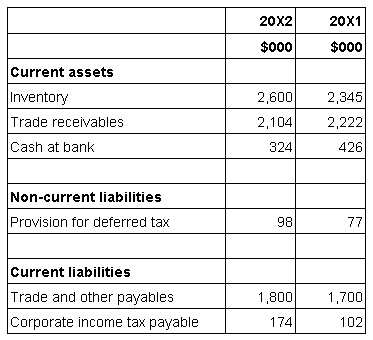

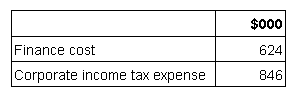

The following information is extracted from OO's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

The following information if included within OO's statement of profit or loss for the year ended 31 March 20X2:

Included within finance cost is $124,000 which relates to interest paid on a finance lease. 00 includes finance lease interest within financing activities on its statement of cash flows.________________

Within OO's statement of cash flow for the year ended 31 March 20X2 which figures should be included to reflect the changes in working capital within the net cash flow from operating activities?

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

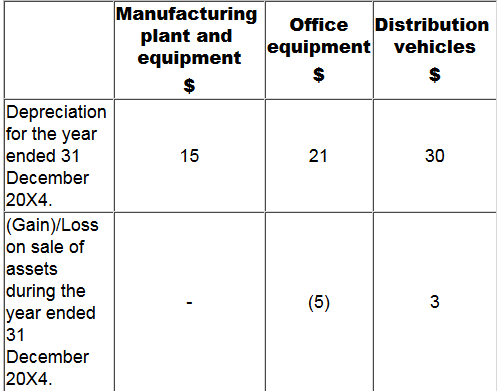

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

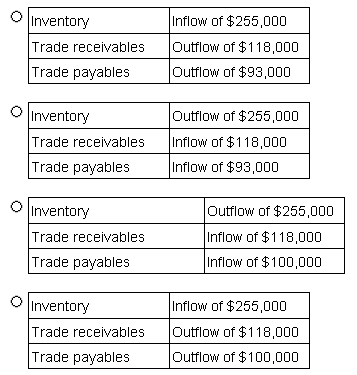

What figures should be entered on the face of the Statement of profit or Loss for the year ended 31 December 20X4 in relation to Interest and Corporate income tax?

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?

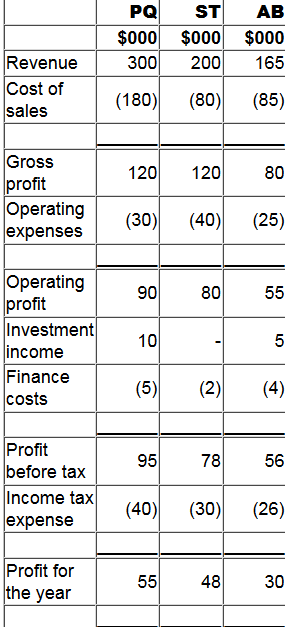

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

Calculate the amount that will be shown as the share of profit of associate in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0.

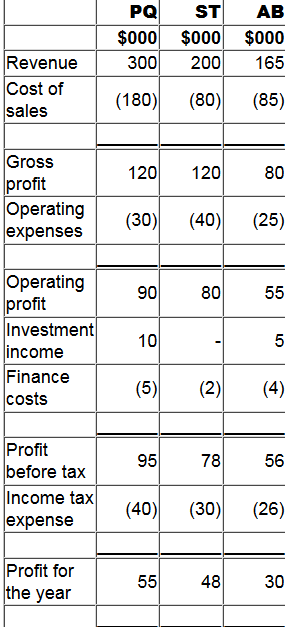

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the value of the unrealized profit in inventory adjustment required to inventory in PQ's consolidated statement of financial position at 31 December 20X0?

Are You Looking for More Updated and Actual CIMAPRA19-F01-1 Exam Questions?

If you want a more premium set of actual CIMAPRA19-F01-1 Exam Questions then you can get them at the most affordable price. Premium CIMA Professional Qualification exam questions are based on the official syllabus of the CIMAPRA19-F01-1 exam. They also have a high probability of coming up in the actual F1 Financial Reporting exam.

You will also get free updates for 90 days with our premium CIMAPRA19-F01-1 exam. If there is a change in the syllabus of CIMAPRA19-F01-1 exam our subject matter experts always update it accordingly.